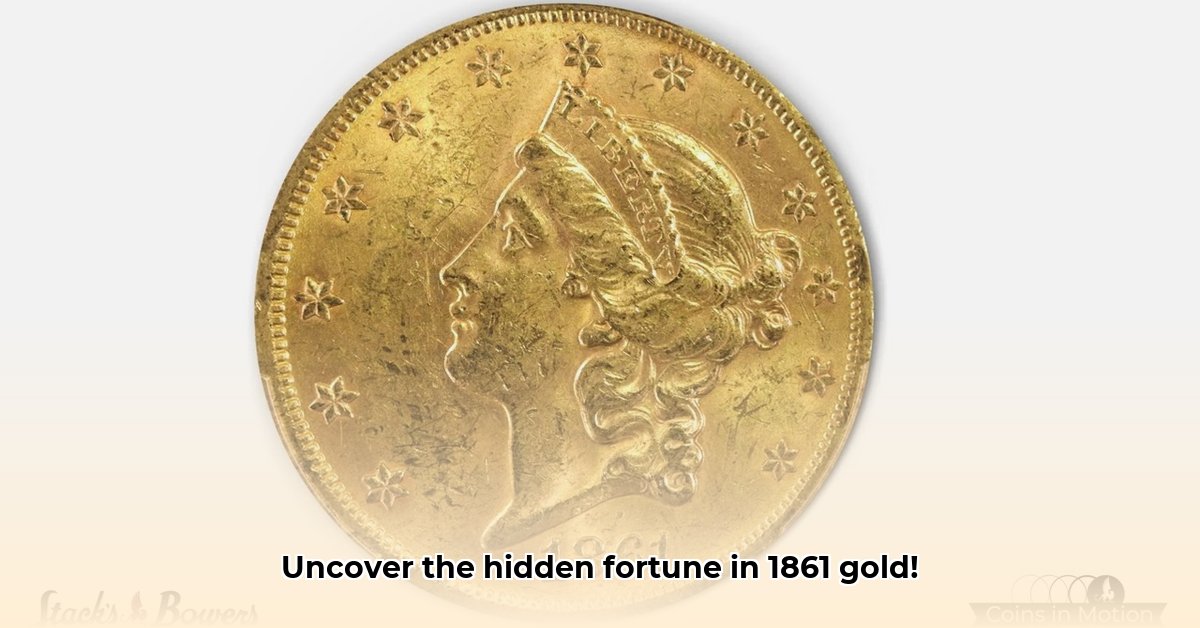

Owning a piece of American history—an 1861 Liberty Head $20 Double Eagle gold coin—offers a unique blend of historical significance and investment potential. Minted during the tumultuous first year of the Civil War, these coins are more than just currency; they're valuable collectibles whose worth can fluctuate significantly. This guide will equip you, whether novice or seasoned collector, with the knowledge to understand, evaluate, and even profit from these remarkable pieces of numismatic history.

1861 Gold Coin: Value, Rarity, and Investment Potential

The 1861 Liberty Head Double Eagle holds a fascinating place in numismatic history. While its relatively high mintage compared to other Civil War-era coins might suggest widespread availability, the actual value varies dramatically. This variance stems from several crucial factors: coin condition, unique characteristics (such as mint marks and die varieties), and prevailing market trends. Understanding these elements is key to unlocking the true potential of this coin.

Decoding the 1861 Gold Coin's Value: A Deeper Dive

Multiple factors influence the value of an 1861 gold coin. Condition is paramount. A coin in pristine condition, exhibiting minimal wear and tear, commands a significantly higher price than a similarly aged coin showing significant wear (scratches, abrasions, etc.). Numismatists use grading scales, such as the widely recognized Sheldon scale, to objectively assess a coin's condition. Grades, such as AU55 (About Uncirculated, 55% of original mint condition) or MS65 (Mint State, 65% of original mint condition), are commonly used to denote a coin's condition. A higher number indicates better condition.

Beyond condition, specific characteristics significantly impact value. Proof coins, struck with extra care for collectors, are exceptionally rare. Mint marks—small symbols indicating the minting location (Philadelphia: no mark; San Francisco: "S"; New Orleans: "O")—also affect rarity and price. Even minuscule variations in the dies used to strike the coins ("die varieties") can substantially increase a coin's value, making these subtle differences a treasure hunt for serious collectors. How rare are these variations? That's a question only diligent research can answer.

Investing in 1861 Gold: A Guide for All Levels

Investing in 1861 gold coins requires a strategic approach, varying based on the collector's experience level:

Beginner Collectors: Begin by focusing on coins graded AU55 to MS62. These offer a good balance between affordability and collectability. Prioritize learning about grading systems and recognizing mint marks. This initial investment in knowledge will yield significant returns over time.

Advanced Collectors: Target rarer varieties, including proof coins or coins with unique die characteristics. Consider having your coins certified by reputable grading services like PCGS (Professional Coin Grading Service) or NGC (Numismatic Guaranty Corporation). Certification provides an independent assessment of a coin's authenticity and grade, adding to its value and marketability. Are you ready to take the next step in your collecting journey?

Dealers and Auction Houses: Extensive knowledge of numismatic grading, exceptional coin identification skills, and understanding of market fluctuations are vital for success. Accurate market pricing requires deep expertise and extensive research. What are the most sought-after characteristics this year?

Navigating the Risks: Protecting Your Investment

Investing in gold coins involves inherent risks:

| Risk Factor | Mitigation Strategy |

|---|---|

| Counterfeit Coins | Purchase only from reputable dealers. Utilize professional authentication services. |

| Market Price Fluctuations | Diversify investments. Monitor market trends closely and adjust strategies accordingly. |

| Grading Inconsistencies | Compare grading from multiple services. Carefully examine certification details. |

| Information Gaps on Rare Variants | Conduct thorough research. Consult with experienced collectors and dealers when needed. |

Legal Considerations: Navigating Regulations

Owning and trading 1861 gold coins is generally legal. However, be aware of regulations regarding the import/export of precious metals and reporting financial transactions exceeding certain thresholds. These regulations vary by jurisdiction. Always ensure your actions comply with all applicable laws.

The Bottom Line: A Piece of History Worth Considering

The 1861 gold coin presents a unique investment opportunity, combining historical significance with potential for appreciation. With diligent research, detailed knowledge of grading and characteristics, and perhaps guidance from experienced numismatists, investing in these coins can be highly rewarding for collectors of all experience levels. Remember that constant learning and adaptation are key to success in the dynamic world of numismatics. How can you further your knowledge to secure the best possible returns?

How to Identify Rare Varieties of 1861 Liberty Head $20 Double Eagles

Key Takeaways:

- The 1861 Liberty Head Double Eagle, while relatively common in lower grades, possesses rare high-grade examples and elusive proof coins.

- The 1861-O Double Eagle, minted in New Orleans, commands higher prices due to limited survival rate and complex historical circumstances tied to the Civil War.

- Identifying rare varieties involves detailed examination for die characteristics, mint marks, and condition. Grade significantly influences value.

- Both coins have demonstrated substantial value appreciation since 2002, particularly higher-grade examples.

The 1861 Liberty Head $20 Double Eagle and the 1861-O (New Orleans mint) offer distinct opportunities for collectors. While both were issued in the same year, their mintage locations and the tumultuous context of the Civil War created significant differences in their rarity and value.

Understanding the Differences: 1861 vs. 1861-O

The primary difference lies in mintage location and historical context. The 1861 Philadelphia mint coins had a much higher mintage, resulting in greater survival rates, especially in lower grades (VF-EF). However, exceptional, higher-grade examples (MS60+) are exceedingly rare. Finding an 1861 proof coin is exceptionally difficult; estimates suggest only a handful exist.

The 1861-O presents a more complex narrative. Minted under varying jurisdictions (Union, Confederate, and potentially Louisiana state authorities), its precise mintage remains uncertain. This ambiguity, combined with generally poor striking quality and subsequent damage, led to a lower survival rate than might be expected given its potential mintage. Does this uncertainty add to or detract from its allure?

How to Identify Rare Varieties of 1861 Liberty Head $20 Double Eagles

Identifying rare varieties necessitates careful examination and numismatic expertise. Consider these steps:

- Mint Mark Examination: The "O" mint mark on the 1861-O instantly distinguishes it from the Philadelphia-minted 1861.

- Date Assessment: A weak or poorly struck date can indicate a less common variety, especially on the 1861-O.

- Die Variety Inspection: Microscopic analysis may reveal die cracks, subtle design variations, or other unique features indicative of specific die pairings.

- Condition Assessment: The coin's grade profoundly impacts its value; high-grade (MS60+) examples are exceedingly rare and valuable.

- Professional Authentication: Submitting coins to PCGS or NGC is crucial for accurate grading and rarity verification.

Investing in 1861 and 1861-O Double Eagles

Both coins offer investment potential, but market prices fluctuate. High-grade examples of both are extremely valuable, though securing them requires considerable effort. A long-term investment strategy, including diversification, is recommended.

Market Trends and Considerations

Both 1861 and 1861-O Double Eagles have shown substantial price appreciation since 2002. However, be wary of overgrading and prioritize accurate authentication. Thorough due diligence is essential before any purchase. What are the current market trends influencing their value?